If you have a donor-advised fund (DAF) set up, you understand the benefits of having a centralized charitable giving vehicle to make a charitable donation which allows you to take an immediate tax deduction. (If you aren’t sure what a DAF is, scroll down for more info.)

If you have a donor advised fund with Fidelity Charitable, Schwab Charitable, or BNY Mellon, you can make your grant to Leaders2Give through the DAF Direct form below.

DAF Direct is a a free and easy-to-use application that enables DAF donors to initiate a grant recommendation directly our our website. Neither you nor Leaders2Give will incur any download or transaction fees.

If your donor advised fund is not listed here, please contact your adviser at your DAF sponsoring organization directly to make your grant.

In the “Designation” field, please indicate how you would like your donation to be directed by choosing one of the following:

John Gullo Home for Children

New Creation Kids Children’s Home

East Cape Community Urgent Care Clinic (Health Center)

Feeding the Hungry

Spay, Neuter and Prevention (SNAP)

Crescent Moon Project - Art For Children

Wonderland for Kids Sponsorship Program

As determined by Leaders2Give based on urgency/demand

If you do not wish to make your DAF grant recommendation via DAF Direct, please direct your DAF sponsoring organization to make checks payable to Leaders2Give Inc. and mail to:

Leaders2Give Inc.

1718 Capitol Avenue

Sacramento, CA 95811

Leaders2Give Inc. Tax ID number/EIN is 83-3621534

For more information, please email us at: donate@leaders2give.org

Donor-Advised Funds Explained

What is a donor-advised fund?

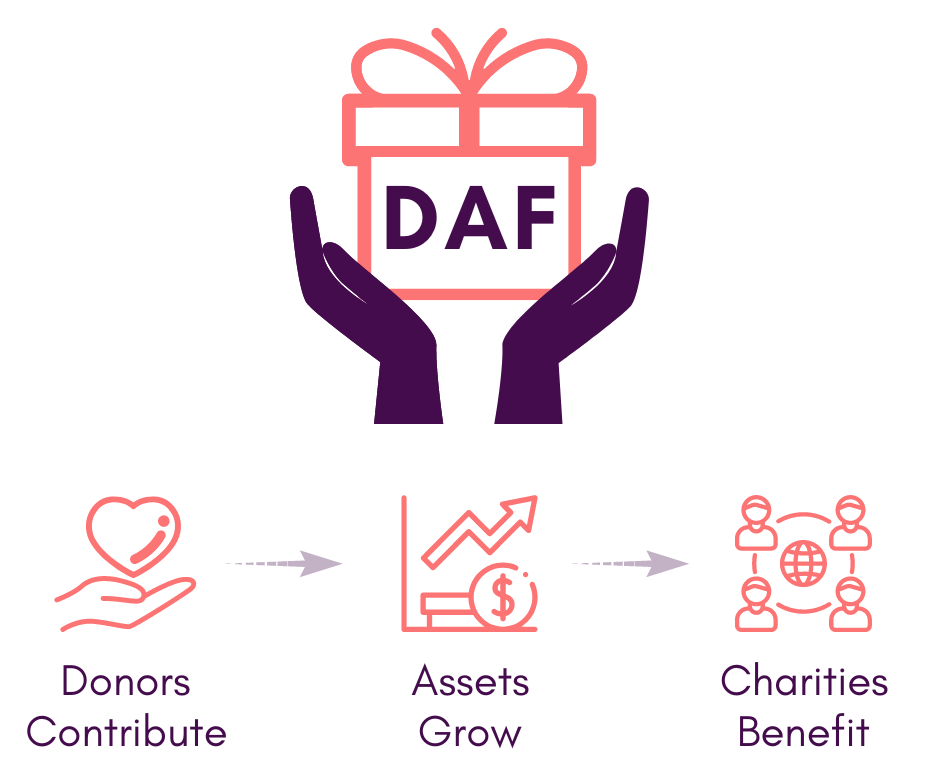

A donor-advised fund is a philanthropic giving vehicle in which an individual deposits contributions without choosing a specific recipient right away. When the donor decides on a recipient, they can send the money from the account to the nonprofit organization as a grant.

Think of a donor-advised fund as a personal investment account. A donor creates a DAF account by donating funds to a sponsoring organization that will actively invest and maintain the funds.

In the US, there are three major types of sponsoring organizations:

National Fund Providers: These are charitable arms of financial service firms like Fidelity, Schwab, and Vanguard).

Community Foundations: Foundations across the country offer donor-advised funds to individuals and families, including The Cleveland Foundation, and Silicon Valley Community Foundation.

Single-Issue Charities: These include Jewish Federations, many universities, and other organizations that manage DAF accounts for their constituents.

In Canada, DAFs are held by public foundations (which are registered charities) such as Aqueduct Foundation. Each foundation has a different mission, policies, and expertise. If you are a also a US tax-payer, you may be able to donate to Leaders2Give via your Canadian DAF and receive a tax benefit.

Donors can contribute to their DAF account as frequently as they’d like. When they deposit assets into the account, they receive the charitable tax deduction immediately without the pressure of selecting a recipient organization right then.

Once the donor contributes assets into the DAF, the sponsoring organization has legal control of the funds. However, the donor (or the donor’s representative) holds the advisory privileges, so they advise the sponsor to direct grants to specific charities.

Most sponsoring organizations of DAFs accept cash equivalents, securities, and certain other assets.

How does it work?

Establish your DAF by making an irrevocable, tax-deductible donation to a public charity that sponsors a DAF program.

Advise the investment allocation of the donated assets (any investment growth is tax-free).

Recommend grants to qualified public charities of your choice.

Main advantages of a donor-advised fund

Simplicity—The DAF sponsor handles all recordkeeping, disbursements, and tax

receipts.

Flexibility—Timing of your tax deduction can be separate from your charitable

decision making.

Tax efficiency—Contributions are tax-deductible, and any investment growth in the

DAF is tax-free. It is also easy to donate long-term appreciated securities, eliminating capital gains taxes and allowing you to support several charities from one block of stock.

Family legacy—A DAF is a powerful way to build or continue a tradition of family philanthropy.

No start-up costs—There is no cost to establish a donor-advised fund. However, there are often minimum initial charitable contributions to establish the DAF (typically $5,000 or more).*

No transaction fees—Once approved, 100% of your recommended grant goes to your qualified public charity of choice.*

Privacy if desired—Donors may choose to remain anonymous to the grant recipient.

* Sponsoring organizations generally assess an administrative fee on the assets in a DAF. These fees vary by the charity that sponsors a DAF program.

Go back to view all donation options available.